The Top 5 Home Care Franchise Opportunities in the U.S.

The home care industry is booming. As Baby Boomers age and more families seek in-home solutions for loved ones, demand for home care services is at an all-time high.

How Apella leverages technology to increase OR efficiency.

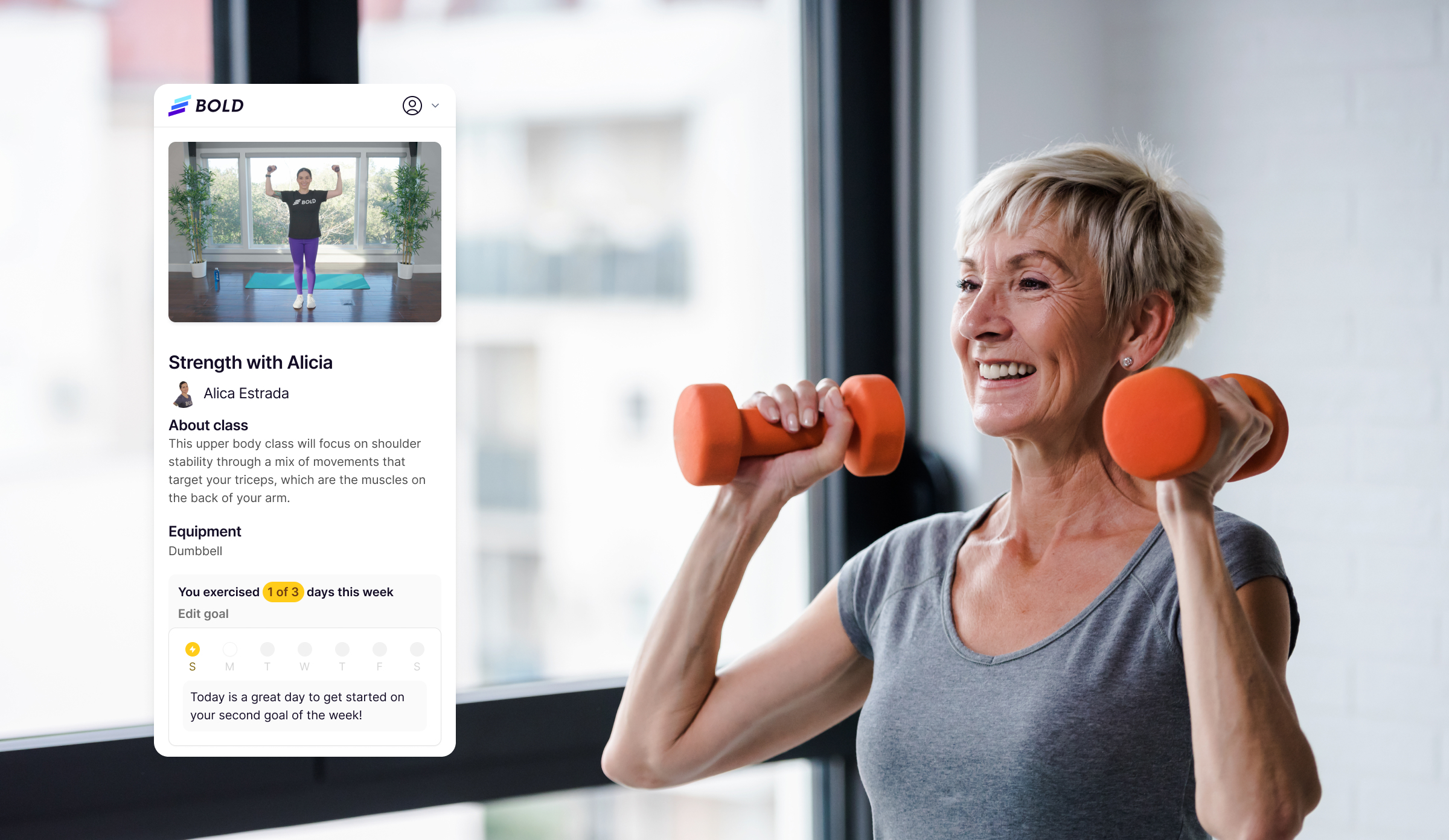

Bold, a Los Angeles-based company offering a healthy aging platform for older adults, closed a $17 million Series A funding round. The startup seeks to improve the health of Medicare Advantage beneficiaries through personalized exercise programs designed to prevent falls, decrease musculoskeletal pain and boost physical activity levels.

Suvida Healthcare — a startup providing primary care for Medicare-eligible Hispanic adults — is adopting Elation Health’s primary care-specific technology platform. The platform comprises an EHR, as well as software for patient engagement, telehealth and revenue cycle management. Suvida's chief medical officer said Elation beat out the competition due to its focus on both primary care and value-based care.

President of Humana’s primary care, Reneé Buckingham, addresses the needs of many seniors facing multiple diagnoses and barriers to high-quality care.

The New York State Office for the Aging announced Wednesday that it is partnering with Intuition Robotics to bring an AI robotic care companion into the homes of 800 older adults as part of the state's efforts to battle social isolation and support aging in place.

Sheila Bond, MD, talked about the latest trends regarding integration of AI in healthcare.

One way MA plans can stand out in an increasingly competitive market is by making members aware of the benefits they may not even know they have and encouraging them to use those benefits.

Wells Fargo Strategic Capital led the Series B funding round. Concerto also announced Thursday that it has acquired Crown Health, a home-based primary care practice serving the Pacific Northwest.

The bill, if enacted into law, will establish an electronic prior authorization process and require Medicare Advantage plans to report on their use of prior authorization and the rate of approvals or denials to CMS. It has 227 co-sponsors in the U.S. House, indicating strong support from both Republicans and Democrats.

Though the Medicare Advantage-focused insurance technology startup is smaller than rivals like Clover Health in terms of membership and revenues, this latest financing round places it ahead of, or at least on par with, several larger competitors with regard to total funds raised.

Richard Fu details the company's approach to nutrition therapy and strategy for patients using GLP-1s.

Through the partnership, Ochsner Health's Medicare Advantage patients will gain access to Bold's platform, which assesses current fitness levels to create a personalized exercise program for users.

The senior care provider currently operates 34 medical centers offering healthcare and social services, like transportation. Through the collaboration, the companies will bring more seniors into value-based arrangements with the goal of improving outcomes for Anthem patients.

Enrollment in Medicare Advantage plans grew rapidly between 2009 and 2018, with the largest increases seen among Black, Hispanic and dual enrollee — that is enrolled in both Medicare and Medicaid — populations. This indicates that payers will need to play a key role in addressing health inequities.

Senior-focused primary care provider Cano Health acquired Doctor's Medical Center for $300 million, which adds around 54,000 new members and 18 medical centers to its roster. This is the second major acquisition for Cano Health in less than a month. The company bought University Health Care for $600 million in mid-June.

Main Street Health, launched by former Center for Medicare & Medicaid Innovation Director Brad Smith, aims to provide value-based care solutions in rural America. The company's first step will be to partner with primary care clinics, urgent care centers and independent pharmacies to implement a program that will coordinate care for seniors.